What is it Solana Blockhain? I will tell you!It is the fastest blockchain in the world and the fastest growing ecosystem in crypto, they have own cryptocurrency SOL. Works with over 400 projects spanning DeFi, NFTs, Web3 and more. Most popular marketplaces for NFT collection : https://solanart.io and https://solsea.io Or you can order your own minting website from me. Look at my portfolio page https://annabnn.com/portfolio/

The boom in the DeFi and NFT spaces have pushed fees on Ethereum extremely high causing crypto users to seek other options like Solana. The founders aimed to create a brand new blockchain that could scale to global adoption. At the time, blockchain transaction speeds were limited to around 15 per second, a throughput that paled in comparison to Visa and Mastercard’s ability to process roughly 65,000 transactions per second. Yakovenko and Gokal sought to make a new blockchain that could meet demand at a global scale.

Solana runs on a hybrid protocol of proof-of-stake (PoS) and a concept Solana calls proof-of-history (PoH).

Proof-of-stake is an algorithm that lets a blockchain maintain accurate information across all of its participants.

With Proof-of-Stake, cryptocurrency owners pledge, or “stake,” their coins to a validator.

A validator is a computer running the blockchains software with its own copy of the blockchain. These validators are the equivalent of miners in a proof-of-work blockchain like Bitcoin’s.

Proof-of-history is a method for proving that transactions are in the correct sequence and found by the right leader.

Solana’s blockchain is broken into slots or periods of time where a validator ingests transactions and produces a block. In this system, leaders are chosen ahead of each slot in order to save time.

Why use proof-of history?

This system lowers latency and increases throughput because slot leaders can stream transactions to the rest of the validators in real-time rather than waiting to fill an entire block and send it at once.

Solana has a theoretical peak capacity of 65,000 transactions per second and has become one of the most highly used blockchains today due to its speed and cheap transaction costs.

Solana’s ambitious design aims to solve the blockchain trilemma , a concept proposed by Ethereum creator Vitalik Buterin , in its unique way. This trilemma describes a set of three major challenges that developers face when building blockchains: decentralization, security and scalability.

Generally, blockchains are built in such a way that forces developers to sacrifice one of the aspects in favor of the other two, as they can only provide two of the three benefits at any given time. You can get decentralization and security but not scalability. Or you can get Decentralization and Scalability but not security.

Solana’s PoH consensus algorithm helps to create more efficiency and higher throughput rate within the Solana network. So by having historical records of events or transactions, it allows the system to more easily track transactions and keep track of the ordering of the events.

Solana can handle up to 65,000 transactions per second, and the average cost per transaction is $0.00025.

Solana has recently launched Solana Pay, a free-to-use payments framework. It allows merchants to accept payments directly from customers through the Solana network. By using Solana Pay, businesses can avoid high payment processing fees.

Solana tokenomics

SOL tokens are its native cryptocurrency and are used to pay its transaction fees. There are currently 315,100,273 SOL coins in circulation with a total supply of 511,616,946 without an established maximum supply.

The SOL token has two use cases. One is staking, where token holders can stake their SOL and receive rewards. The other allows users to use SOL as payment for fees associated with running smart contracts or other transactions.

Additionally, Solana distributes a fixed amount of inflation-based rewards across its weighted validator set that secures the Solana network. Each staking reward is weighted by the number of tokens that are staked. Yield is proportional to the number of tokens staked measured against the total token supply.

Solana launched with an inflation rate of around 8%, which is expected to decline by 15% each year, a downward trend that will decrease until the rate reaches 1.5% annually, where it will remain. Issuance’s are anticipated to be sent to validators, with 95% of issued tokens toward validator rewards and 5% reserved for operating expenses.

Smart contract support

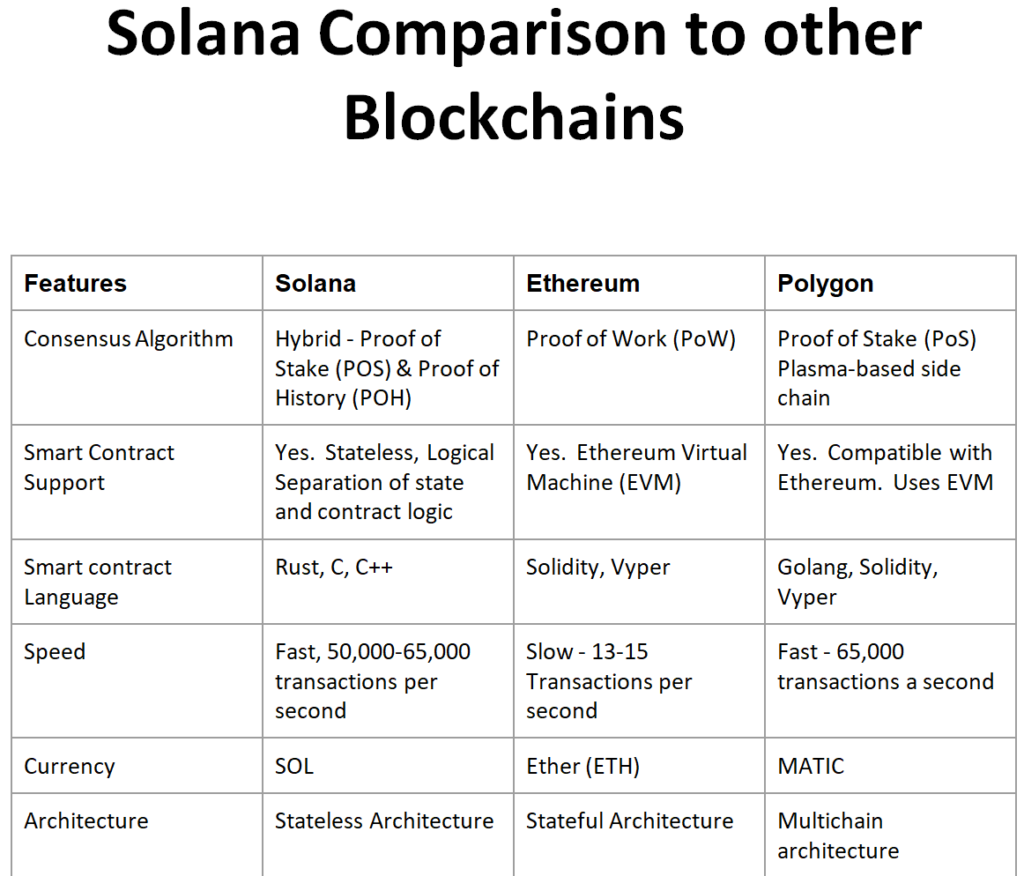

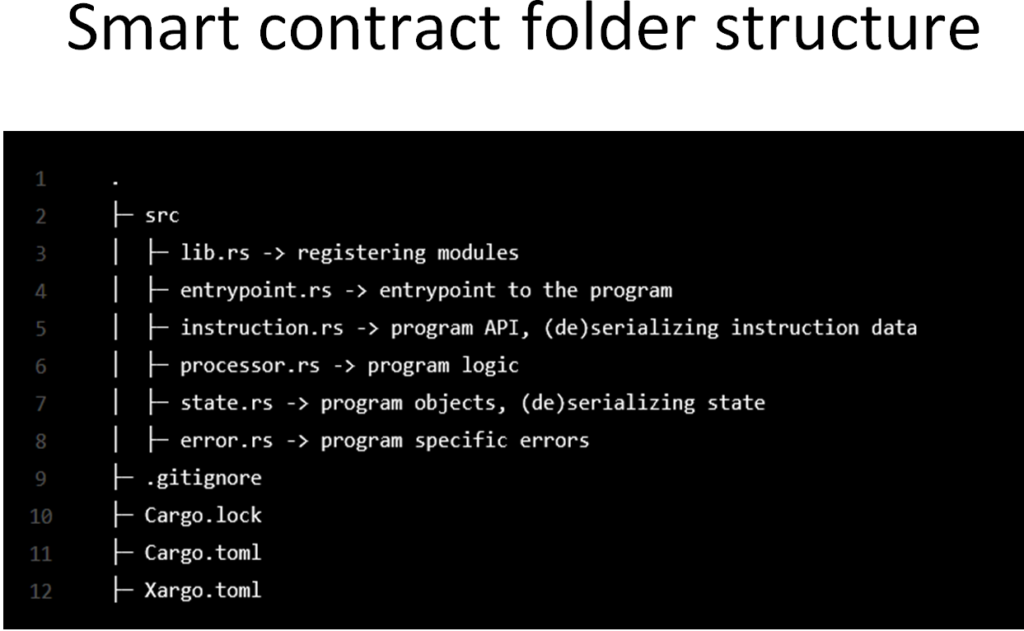

Solana offers a different smart contract model to traditional EVM-based blockchains. In traditional EVM-based chains, contract code/logic and state are combined into a single contract deployed on-chain. With Solana, a smart contract (or program) is read-only or stateless and contains just program logic. Once deployed, smart contracts can be interacted with by external accounts. The accounts that interact with the programs store data related to program interaction. This creates a logical separation of state (accounts) and contract logic (programs). This is the crucial difference between Solana and EVM-based smart contracts. Accounts on Ethereum are not the same as accounts on Solana. Solana accounts can store data (including wallet information) as opposed to Ethereum accounts, which are references to people’s wallets.

Speed

Ethereum is is very popular due to which it has a lot of crowd waiting to verify their transactions. Therefore, the participant will either have to wait for a long time or pay a huge fee for verification. Due to this, only a limited number of transactions are processed every second, which can range between 13-15.

When it comes to Solana and Polygon, they are more advanced in terms of transaction speeds and offer 50,000-65,000 transactions per second which are a lot faster.

Solana depends on Tower Byzantine Fault Tolerance of TBFT which prevents real-time communication among nodes and reduces the time taken, increasing efficiency overall.

Polygon on the other hand has the fastest speed. Since it provides a hybrid environment, it has the fastest transaction speed of 65,000 transactions a second.

Architecture

Ethereum has undoubtedly one of the best stateful architectures among the competition due to which it is widely used for making apps on the blockchain platform. The platform records all the transactions in the existing state and copies of the latest transactions are immediately coined to mirror the recent transactions. It is an effective network but is slower when compared to stateless networks. Polygon comes with the idea of a borderless society and economy where it works like POS blockchain and exchanges are present in the form of clusters. Solana on the other hand is based on a cluster architecture that works on Solana clusters. It is basically a collection of validators that together address the client transactions with ledger maintenance. Every cluster has its own validator and the roles of each validator continue to rotate among them. The leader of the cluster will build and timestamp the transaction with PoH consensus. It is a stateless architecture and due to this, the whole state of Solana architecture does not need to update every time. It is why both Solana and Polygon are very efficient and provide faster transactions.

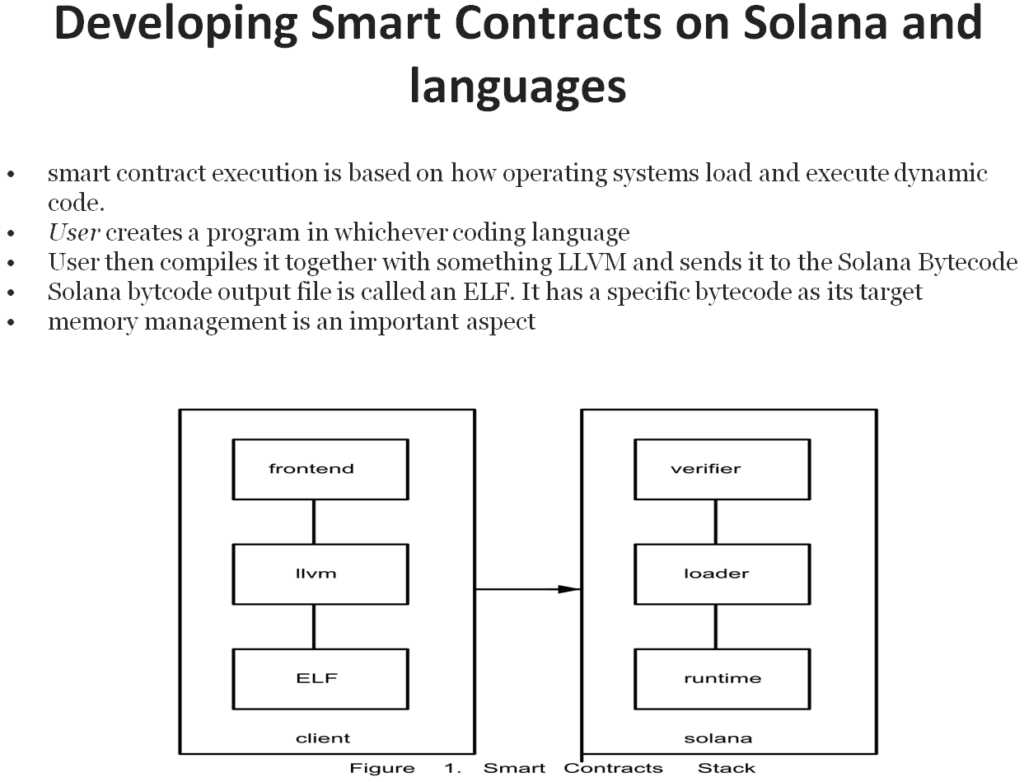

Solana’s approach to smart contract execution is based on how operating systems load and execute dynamic code. So, let’s have a look at the image above. As you can see, the client creates a program in whichever coding language, and then compiles it together with something called LLVM and sends it to the Solana Bytecode.

LLVM refers to a low-level virtual machine. It also refers to a compiling technology called the LLVM project

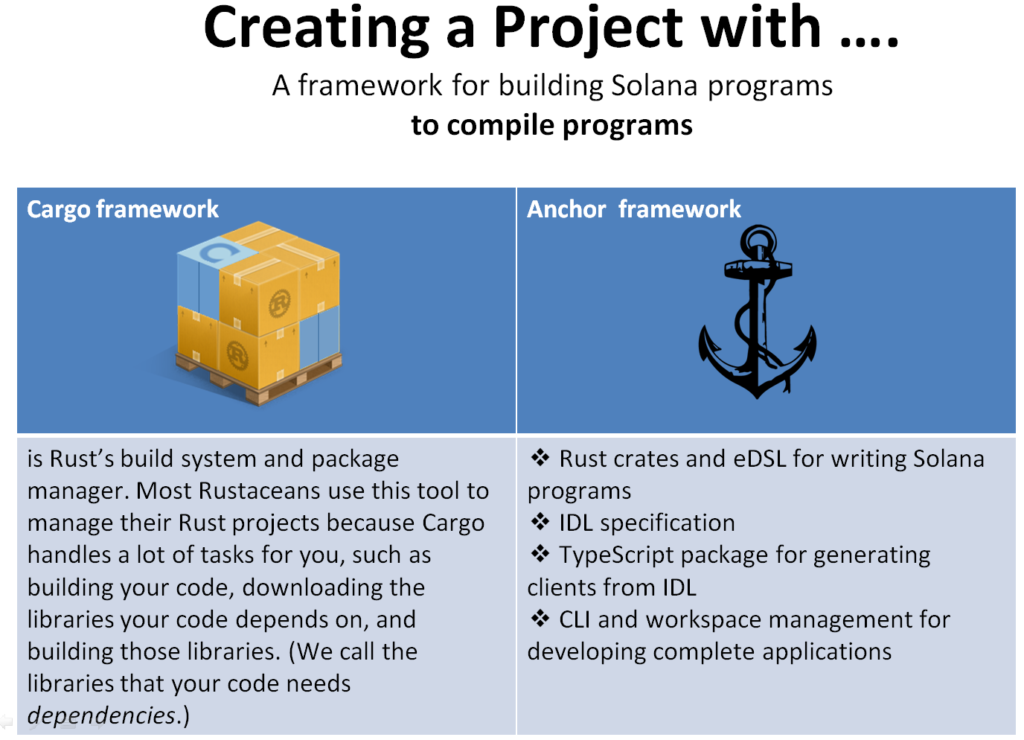

Solana on-chain programs are compiled via the LLVM compiler infrastructure to an Executable and Linkable Format (ELF) containing a variation of the Berkeley Packet Filter (BPF) bytecode.

Because Solana uses the LLVM compiler infrastructure, a program may be written in any programming language that can target the LLVM’s BPF backend. Solana currently supports writing programs in Rust and C/C++.

Loaders

Programs are deployed with and executed by a runtime loader called the BPF Loader

Loaders may support different application binary interfaces so developers must write their programs for and deploy them to the same loader

The BPF Upgradeable Loader marks itself as “owner” of the executable and program-data accounts it creates to store your program. When a user invokes an instruction via a program id, the Solana runtime will load both your the program and its owner, the BPF Upgradeable Loader. The runtime then passes your program to the BPF Upgradeable Loader to process the instruction.

The runtime only permits the owner program to debit the account or modify its data. The program then defines additional rules for whether the client can modify accounts it owns. In the case of the System program, it allows users to transfer lamports by recognizing transaction signatures. If it sees the client signed the transaction using the keypair’s private key, it knows the client authorized the token transfer.

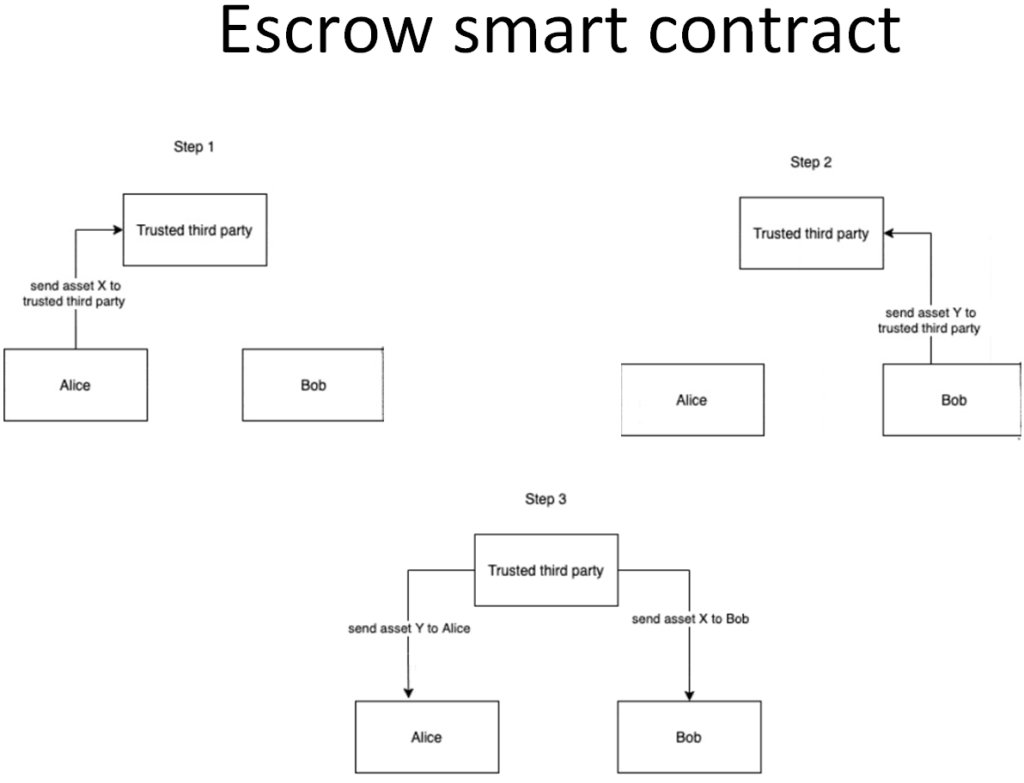

Imagine Alice has an asset A and Bob has an asset B. They would like to trade their assets but neither wants to send their asset first. After all, what if the other party does not hold up their end of the trade and runs away with both assets? A deadlock will be reached where no party wants to send their asset first.

The traditional way to solve this problem is to introduce a third party C which both A and B trust. A or B can now go first and send their asset to C. C then waits for the other party to send their asset and only then does C release both assets.

The blockchain way is to replace the trusted third party C with code on a blockchain, specifically a smart contract that verifiably acts the same way a trusted third party would. A smart contract is superior to a trusted third party because of a number of reasons e.g. can you be sure that the trusted third party isn’t colluding with the person on the other side of the trade? You can be sure with a smart contract because you can look at the code before running it.

1. Magic Eden

Magic Eden is the most popular Solana NFT marketplace, where you may manufacture, sell, and purchase NFTs. They don’t charge a listing fee, but they do charge a transaction fee of 2%. However, creators can specify their royalties and get paid as soon as a sale is made. They are currently only accepting a restricted number of projects, and Magic Eden supports almost all Solana wallets.

2. Solanart

Solanart is one of the popular Solana NFT Marketplaces that allows anyone to create, sell and buy Solana-based NFTs. For every successful NFT sale, Solanart charges a transaction fee of 3%. However, the creator has the ability to determine their own fee. Moreover, Degenerate Ape Academy, Aurora, Solpunks, and Galactic Gecko Space Garage are just a few of Solanart’s popular NFT collections.

3. Solsea

Solsea is the first Solana NFT marketplace, assisting creators in the minting and purchase of NFTs. Solsea also introduced NFTs with rarity ranks and NFT compatibility with SPL tokens. However, with Solsea’s calendar function, you’ll never miss a project’s forthcoming drops. Solsea’s NFT collection includes base markets, All.ART Circle, and Meta Waifus, among others. Solsea’s “First 100” is the first Virtual NFT Art Fair of its type, showcasing the pioneers and early adopters.

4. DigitalEyes

Solana’s first open NFT marketplace, DigitalEyes, allows users to make, sell, and buy Solana’s NFT. DigitalEyes’ top NFT collections include Aurory, Degenerate Ape Academy, Frakt, and Galactic Gecko Space Garage are among DigitalEyes’ top NFT collections. However, you can see the forthcoming NFT drops and launches using the Mint Calendar. However, DigitalEyes charges 2.50 percent of each successful NFT sale as a service fee. Moreover, DigitalEyes supports wallets including Phantom, Sollet, Solflare, Solong, Slope, and MathWallet.

5. Metaplex

Metaplex is one of the best Solana NFT marketplaces. Instead of putting your NFT on the open market, where it will compete with other NFT ventures. Your project will be displayed according to the marketplace’s guidelines and standards, which could be a huge disadvantage for your company. However, Metaplex allows you to create your own branded Storefronts. The Megaplex storefront is linked to a decentralized on-chain application that mints and sells NFTs. For each successful NFT transaction, you may be able to avoid marketplace costs.